Interesting Factors On How Credit Limit Impact Your Credit Score

Visas accompany a credit limit; this breaking point differs starting with one card type then onto the next and is reliant upon different variables. The pay of the candidate is one of the principle factors that decide as far as possible when one applies for a card separated from a large group of elements. Credit limit is the greatest sum that is a card client can spend on the gave card.

Subsequently assuming a card has a restriction of Rs. 100,000 then the client can spend up to that sum in a charging cycle. When the duty are reimbursed then the cutoff is again set to Rs. 100,000 for the following charging cycle. Insights concerning all your dynamic cards alongside their cutoff points are referenced in the CIBIL Report.

Effect of Credit Limit on Credit Score:

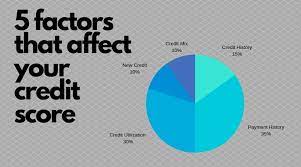

Presently let us investigate the effect of credit limits using a credit card rating assuming any. As we examined above credit usage is one of the five factors that sway the financial assessment. Credit use thusly is impacted by as far as possible and the card utilization.

Credit Utilization = Card Usage/Credit Limit

This is determined for each card and furthermore all cards set up. Along these lines assuming there is a charge card with a restriction of Rs. 100,000 and the normal charging for that card is Rs. 35,000 then the use for that card is 35%. Assuming there is one more card with 150,000 and the normal utilization for that card is additionally Rs. 35,000 the usage proportion for that card is 23.33% and for both the cards set up the use apportion is 28%.

In this way when the score is being determined then the credit use of all cards separately and all things considered is considered. A high credit usage proportion isn't useful for the FICO score. So in case somebody has a continually high Visa utilization (over 30% of as far as possible then they should check out getting a greater card limit endorsed.

Getting a greater cutoff will help the client manage the high use proportion; a continually high credit use proportion could bring about low CIBIL score. This angle after reimbursements history is the greatest supporter of the FICO rating.

Anyway recall a higher breaking point for your Visa will possibly help on the off chance that you can satisfy your Mastercard obligations on schedule and hold your spending within proper limits. A higher cutoff isn't a reason to spend more, as this will invalidate the point of getting it expanded and may prompt more concerning issues assuming you neglect to satisfy the obligations on schedule.

For what reason is High Credit Utilization a Problem?

One might contemplate whether he/she can compensate the duty on schedule for their charge card and the spending is inside as far as possible why is high usage an issue? It is an issue since it uncovers credit hungry conduct on piece of the card client. It additionally shows a high danger profile for the card client, the two of which are bad finishes paperwork for credit wellbeing.

Komentar

Posting Komentar