Financial Fitness for the Rest of Your Summer

Summer is mostly finished and the warm climate, Bbq's, and excursions have currently likely placed a scratch in your financial plan. It's an ideal opportunity to reexamine your cash objectives by keeping tabs on your development up to this point. Remain proactive about overspending by executing shrewd methodologies that will keep you monetarily fit for the span of the late spring.

Audit Your Current Summer Budget

Following a month into the mid year season, is your spending plan holding consistent? It's consistently reasonable to survey your present costs with an end goal to figure out where you can scale back. It's clear that individuals spend more in the mid year so execute those intensified spending regions into your financial plan. Evaluate your common costs by examining your charge and Visa action. In case you're paying for things or administrations you never utilize then dispose of them. This will leave you more for your finish of summer fun!

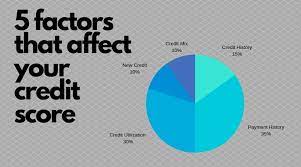

Survey Your Debt

Be straightforward, would one say one was of your fresh new goals to take care of your obligation? Like the greater part of us, did that idea rapidly blur? In case this is you, then, at that point, it's time you do a genuine assessment of your obligation. Is it accurate to say that you are feeling a piece obligation exhausted or would you say you are en route to arriving at your obligation free objective? In case you cleared the objective of taking care of your obligation away from view then, at that point, perhaps it's an ideal opportunity to recall why it's significant for you by and by to escape obligation. What are your dreams for what's to come? What does your life after obligation resemble? Assuming that is the existence you need then, at that point, begin expanding your installments by just $5, which can have an extraordinary generally impact without placing a pleat in your mid year plans.

Reduce Energy Expenses

Attempt to reduce energy expenses any place you can in the late spring. As a matter of first importance, barbecue outside more regularly. This will cut the quantity of dishes utilized just as the quantity of dishwasher cycles. Turn off inward lights and rely upon regular daylight. Assuming it's to hot external then close the blinds to keep it cool inside the house. Water plants with a watering can as opposed to allowing the hose to run and have a go at drying garments outside on an older style clothesline to try not to utilize the dryer.

There are a huge load of deals throughout the mid year months that can help you save. Food shopping can be particularly severe with your spending plan. Maximize your cash by using store coupons and actually looking at your neighborhood store brochures. We suggest utilizing Flipp, a free application that can assist you with social occasion all the store fliers in your neighborhood. This application can assist you with saving 20-70% consistently on your basic food item bill.

Handle the Strength in Old and Discounted Gift Cards

When was the last time you cleared out your wallet and observed old gift vouchers? These can assist you with enhancing your late spring feasting or shopping while holiday. You may not have a clue about this yet you can purchase gift vouchers at a markdown. Raise.com can assist you with setting aside cash in two distinct ways:

- You can sell your old or undesirable gift vouchers for cash, which would then be able to be utilized, towards your mid year exercises.

In the event that your mid year plans have busted your spending plan what about hurrying along some additional money. Imagine a scenario where you lease a room out in your home on Airbnb. You can canine sit for canines by publicizing on dogvacay.com, or drive for a ride share administration. Thus, quit griping that you are shy of money. Be innovative and utilize the choices that are out there hanging tight for you.

It's extremely advantageous to swipe your card any place you go. Research shows that utilizing cash as your installment of decision eventually controls the sum you will spend by 12 - 18%. Elizabeth Jenkins, a hard-cash loaning master, proposes you put your money financial plans into week after week envelopes. "Have an envelope for week after week food, diversion, gas, lease/contract. You'll feel regretful in case you take cash from the envelopes for inconsequential costs."

Going through cash can become habit-forming. What about investing 'energy' in things as opposed to burning through cash on things. Zero in on exercises that will grow your prosperity as opposed to buying and gathering material things. For instance, start an activity program; track down a side interest or work on redesigning your home. All in all, put your energy into projects that might cost you some cash yet will be more useful to your home or family.

You can't be excessively unbending with your cash. It most certainly needs to adjust to your life. Summer is half finished so begin outlining the remainder of the late spring so you can abstain from overspending and delving yourself more profound into obligation.

Komentar

Posting Komentar